Welcome to Diamond Communication’s new website!

We’re proud to provide an updated mobile responsive way for you to reach out to us to book your Business Telephone system today!

We also support a large base of legacy equipment such as Nortel, Samsung, NEC, and Toshiba

Serving Victoria, Nanaimo, and the Island Business Community Since 1988. We are a full service telecommunications, customer-oriented company, committed to long-term relationships. We design IP, Cloud, SIP and traditional telecommunications solutions according to your communications goals and challenges, and help you make sense of simple, suitable solutions which can easily be managed by IT support, or trained staff. Highly adaptable and scalable appliance and cloud-based applications and solutions tailored to IP or Digital voice support, unified messaging, voicemail, mobility, cellular, call centers, headsets, audio and video conferencing. We also install structured wiring solutions for telecom and network cabling, wireless solutions, music on hold, overhead paging, and our business and our staff are experienced and certified.

Diamond Communications has a wealth of product experience and knowledge and are always ready to provide support and solutions to customer telecommunications challenges, regardless of how dated or recent the customer’s technology may be.

We work with you online, over the phone, or in person to provide the type of service and response times that work for you, as well as to tailor communications solutions based on expectations and requirements.

It is our goal to help you realize day to day communications requirements and future expectations in terms of manageability, growth and technology.

We have built our company based on trust, honesty and service and we look forward to hearing from you.

A traditional phone systems uses analog phone lines, otherwise known as a land line, that connects directly to your phone system (PBX). Landlines have been in use for over 100 years and are a reliable form of communication. With a landline, you have a metal wire connecting your phone system with the central office, which connects you to other systems in the region when making a call. Most modern phone systems are hybrid, meaning you have a choice across multiple forms of phone lines from analog (landline), PRI (Primary Rate Interface), VoIP (voice over internet protocol), or a combination. We work with all kinds of phone lines and systems and can help you decide which type is right for you.

VoIP, or voice over internet protocol, is a method of using the internet to support your voice communication. VoIP phone systems most often use IP phones but hybrid systems can support a mix of phone lines and desk phones using different technology. VoIP became popular in the mid 2000s and is a proven technology. When using VoIP, your desk phones and/or phone system will connect to data connections just like your computer does. Benefits of VoIP include cost reduction for phone lines and long distance calling, flexibility with the capability of working remote, and improved feature-set of the desk phones.

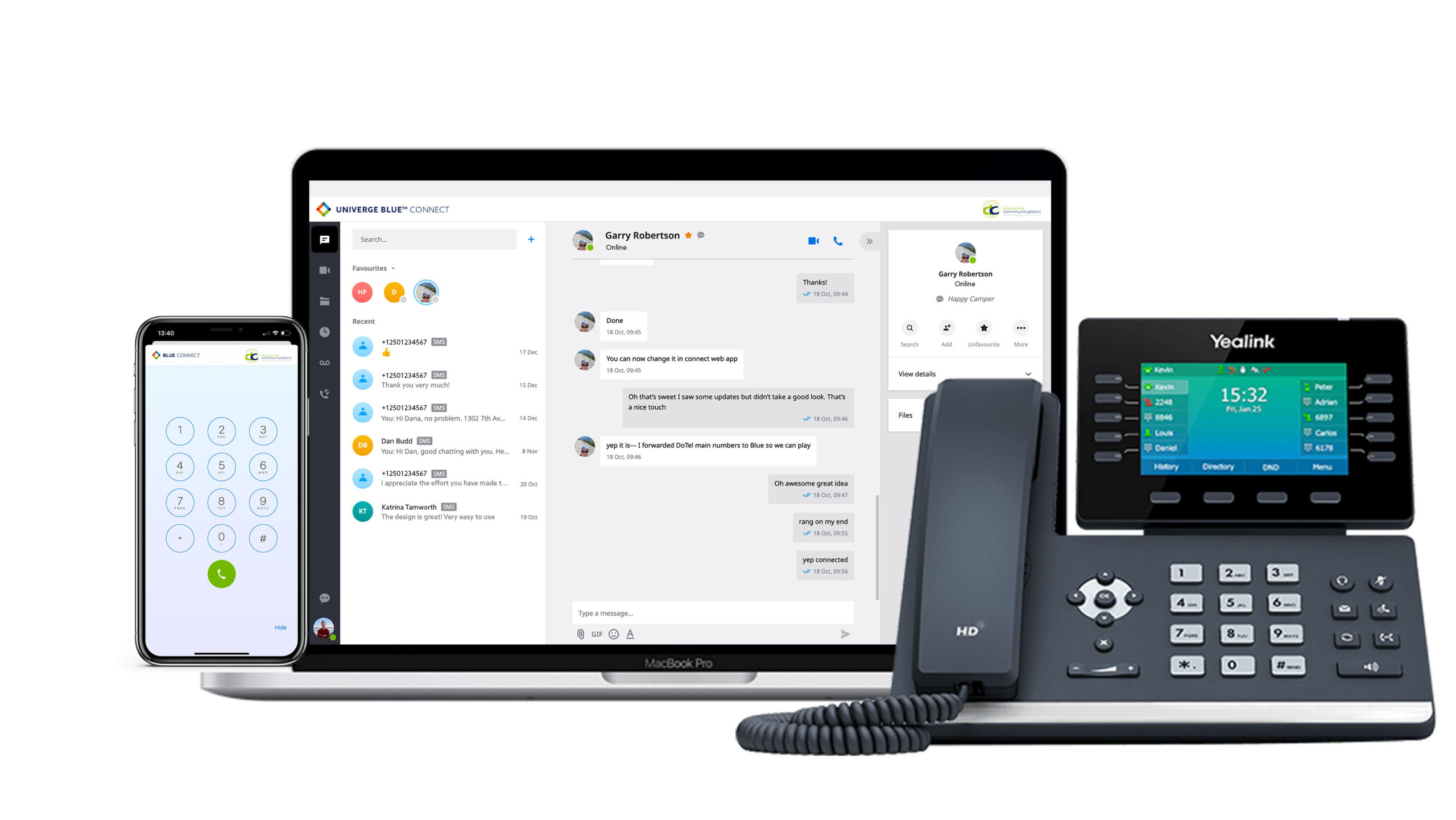

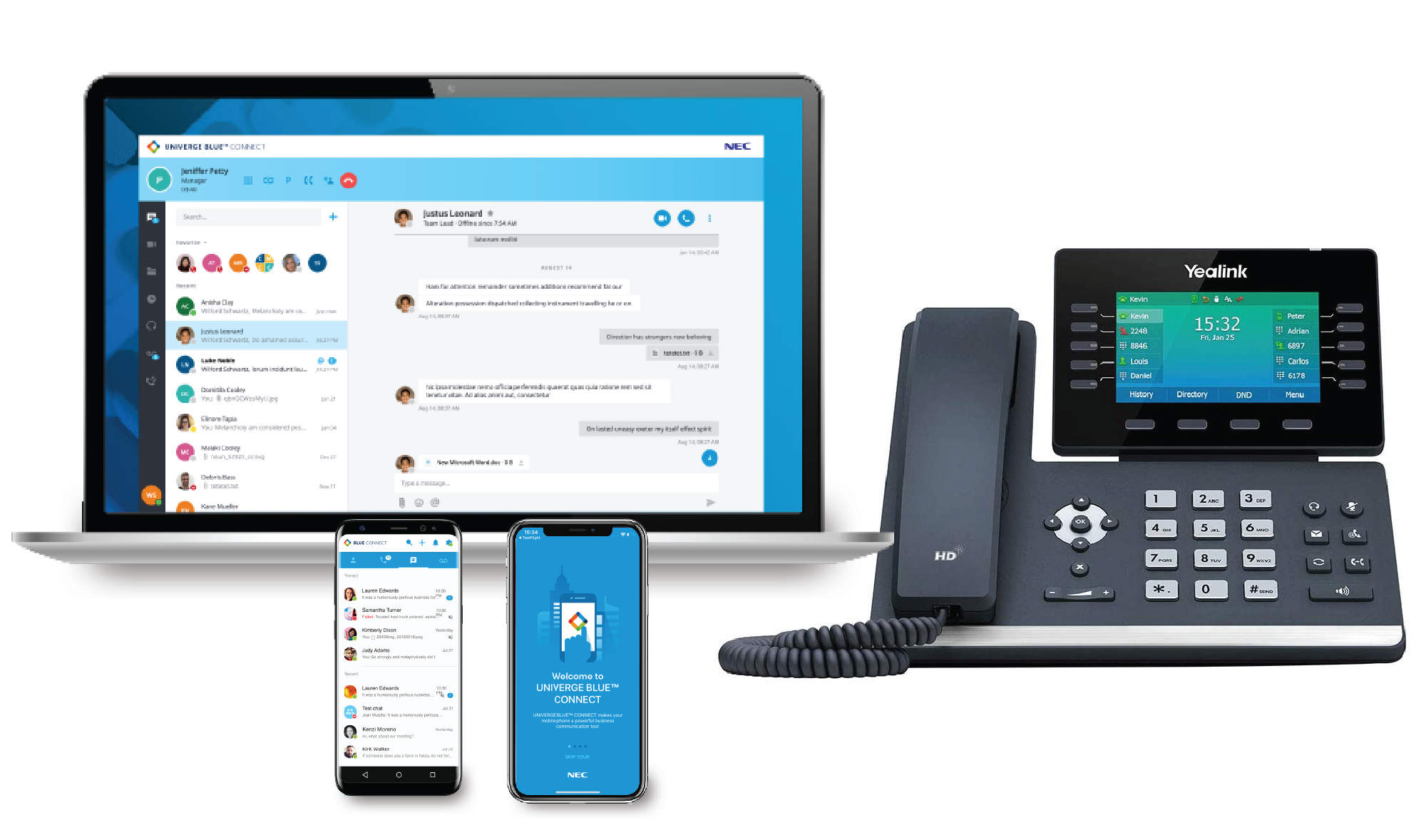

A cloud based phone system works similar to a VoIP phone system; however, a cloud based phone system uses a data centre to manage calls and programming. With a cloud phone solution, users only need either their desk phone or app to experience business calling. The phone system provider takes care of the rest. Because of this change, businesses have a much lower upfront cost to use an enterprise level phone system and users gain access to advanced features and business applications through their cell phones and computers. On top of cost savings, remote working is easy with a cloud solution because there is no need for a VPN to connect to the main office, so business communication can be taken anywhere. Cloud phone systems use your internet connections, so be sure to reach out to us for a free VoIP Scout test to see if your network will support high quality audio.

An array of reliable desktop phones suited for your office environment and communication needs.

Monitor your entrances to enhance the security of your locations with enhanced audio and video capabilities.

Access your office phone anywhere using your smartphones, to work remotely or on the go.

Reliably access, host, and record conferences from worldwide using our custom remote solutions.

For you or your employees are on the go, we offer quality cordless solutions with a variety of features.

Effectively manage your customers by redirecting calls, providing on-hold messaging and much more.

We’re proud to provide an updated mobile responsive way for you to reach out to us to book your Business Telephone system today!

Toshiba Phone Systems

Toshiba Phone Systems

Toshiba Phone Systems

Toshiba Phone Systems

Toshiba Phone Systems

Thank you for your interest in Diamond Communications. Please fill out the contact form below or give us a call at 250 383 1003.

Please click on Quote Solutions below and call or office at 250 383 1003 to discuss

© Diamond Communications is a Vancouver Island owned-and-operated telecommunications company based in Victoria and Nanaimo, BC. Website by Webacom